Copyright Act, 1957 — Ss. 51, 14 and 55 — Infringement of copyright in copy-edited version of judgments published in Supreme Court Cases (SCC): Copyrights in copyedited versions of judgments published in Supreme Court Cases (SCC) as recognized and upheld in Eastern Book Company v. D.B. Modak, (2008) 1 SCC 1, affirmed by the directions to appellant-defendants to follow the law laid down in Modak case while publishing, selling and distributing the raw judgments of the Supreme Court with their own inputs. [Relx India (P) Ltd. (Formerly Reed Elsevier India (P) Ltd.) v. Eastern Book Co., (2017) 1 SCC 1]

Tort Law — Employees’ Compensation Act, 1923 — Ss. 30 and 4(1) (c)(ii) — Appeal to High Court — Interference with findings of facts by High Court — When permissible: When there is no perversity in findings of fact of authorities below, interference with findings of fact, impermissible in such circumstances. [Golla Rajanna v. Divl. Manager, (2017) 1 SCC 45]

Service Law — Retirement/Superannuation — Retiral benefits — Gratuity and pension: As there were no departmental proceedings initiated against respondent for alleged discrepancy in stock in store of Department which was noticed after more than five months of retirement of respondent nor any proceedings as envisaged under Art. 351-A resorted to, hence, no interference with impugned judgment affirming order of Single Judge of High Court directing release of remaining amount of pension and gratuity called for. [State of U.P. v. Dhirendra Pal Singh, (2017) 1 SCC 49]

Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 — Ss. 13(2), 17 and 34 r/w S. 1(4) of Recovery of Debts Due to Banks and Financial Institutions Act, 1993 — Jurisdiction of Debts Recovery Tribunal (DRT) where amount of debt due is less than Rs 10 lakhs: DRT has no original jurisdiction to entertain suit or application where debt is less than Rs 10 lakhs, but, it can exercise appellate jurisdiction in terms of S. 17 of 2002 Act even if amount involved is less than Rs 10 lakhs. In view of specific bar under S. 34 of 2002 Act, no civil court has jurisdiction to entertain any suit or proceeding in respect of any matter which a DRT or DRAT is empowered to determine the dispute under 2002 Act. Thus, civil court has no right to issue any injunction with reference to any action taken under 2002 Act or under 1993 Act. [State Bank of Patiala v. Mukesh Jain, (2017) 1 SCC 53]

Kerala General Sales Tax Act, 1963 (15 of 1963) — S. 5(2) — First sale of goods — When can be inferred — Second sale exemption — Entitlement to: For being considered as first sale of goods under S. 5(2), the following conditions are to be satisfied: (i) sale is of manufactured goods being other than tea; (ii) sale of the said goods is under a trade mark or brand name; and (iii) sale is by the brand name holder or the trade mark holder within the State. Further, the objective of S. 5(2) of KGST Act is to assess the sale of branded goods by the brand name holder to the market and the inter se sale between brand name holders is not intended to be covered by S. 5(2) of the KGST Act. In present case purported “first sale” was only a device to reduce tax liability, hence assessee not entitled to second sale exemption. [Kail Ltd. v. State of Kerala, (2017) 1 SCC 60]

Prevention of Corruption Act, 1988 — Ss. 19, 13, 7, 10, 11 and 15 — Sanction for prosecution: For IRS officer cadre controlling authority is Finance Minister of India and as such sanction for prosecution granted by him was valid sanction. Further held, fact that in administrative notings different authorities like CVC, DoPT had opined differently, is inconsequential since business of State being complicated, it has necessarily to be conducted through agency of large number of officials and authorities. Besides, ultimate decision to accord sanction was taken by Finance Minister who was the competent authority.Moreover, sanction was accorded after proper application of mind and at no point there was decision not to grant sanction so as to give decision to grant sanction colour of review. Opinion of CVC which was reaffirmed and ultimately prevailed in according sanction cannot be said to be irrelevant. [Vivek Batra v. Union of India, (2017) 1 SCC 69]

Contempt of Court — Civil Contempt — Interpretation/doubt as to order — Contempt petition — When can be considered as review petition to clarify such doubt: As dispute between the parties required determination of date from which interest was required to be paid in terms of court order which was omitted in said order, therefore, issue considered not under contempt jurisdiction but in review jurisdiction. [Dravya Finance (P) Ltd. v. S.K. Roy, (2017) 1 SCC 75]

M.P. Electricity Duty Act, 1949 (10 of 1949) — S. 3(1) — Term “processing” as used in definition of “mines” — Interpretation of: In Expln. (b) to S. 3(1) words, “crushing”, “treating” and “transporting” are words of narrower significance and the word “processing” used between these words should not be given a very wide meaning, for the legislative intent, is narrower. Further, the word “processing” would mean those processes with the help of hands or machineries connected and linked to mining activity and would not include process by which a new or different article other than the one which has been mined, is produced. Therefore, “processing” in the said context would mean activities in order to make the mineral mined marketable, saleable and transportable, without substantially changing the identity of the mineral, as mined. S. 3(1) prescribed different rates of duty depending on the purpose for which the electrical energy is sold and the “rate of duty as percentage of the electricity tariff per unit” for mines was specified as 40. Further, ferromanganese alloy manufactured by the appellant using the mineral manganese at its ferromanganese plant was an entirely different product from its mineral raw material (manganese ore) both physically and even chemically. Also, unlike manganese ore a ferromanganese alloy can never be found in the natural state and it has to be manufactured from the manganese ore and other minerals only. The same logic applied to copper concentrate also, as a different and distinct product comes into existence. Hence, conversion of mineral ores i.e. manganese ore to ferromanganese and copper ore to copper amounts to “manufacturing” and hence was liable to tariff applicable to manufacturing units. [Manganese Ore India Ltd. v. State of M.P., (2017) 1 SCC 81]

Penal Code, 1860 — Ss. 304-B and 498-A r/w S. 113-B, Evidence Act, 1872 — Dowry death — Presumption under S. 113-B — Invocation of: Mere factum of unnatural death in matrimonial home within seven years of marriage is not sufficient to convict accused under Ss. 304-B and 498-A. Only when prosecution proves beyond doubt that deceased was subjected to cruelty/harassment in connection with dowry demand soon before her death, presumption under S. 113-B can be invoked. [Baijnath v. State of M.P., (2017) 1 SCC 101]

Criminal Procedure Code, 1973 — Ss. 340 & 195 — Initiation of prosecution for perjury — Preconditions therefor: Mere fact that a contradictory statement was made in judicial proceeding is not by itself sufficient to justify prosecution for perjury. It must be established that such act was committed intentionally. [Amarsang Nathaji v. Hardik Harshadbhai Patel, (2017) 1 SCC 113]

Infrastructure Laws — Water and Water Resources — Interlinking of river projects/Networking of rivers — Sutlej- Yamuna Canal link — Sharing of river water by State of Punjab with State of Haryana: Haryana is constructing canal on its side by making huge investments but State of Punjab delaying in constructing canal in spite of valid agreements and decree under Art. 131 and orders of Supreme Court to complete it within specified time period, instead State of Punjab enacting the Punjab Termination of Agreements Act, 2004 to discharge itself of its obligations under said agreements and decree and final order of Supreme Court, hence, Punjab Act, held, invalid. [Punjab Termination of Agreement Act, 2004, In Re, (2017) 1 SCC 121]

Hindu Adoption and Maintenance Act, 1956 — S. 12(c) — Applicability: After vesting of undivided shares of other heirs in the said other heirs, adoption has no effect on such vested undivided shares. [Saheb Reddy v. Sharanappa, (2017) 1 SCC 142]

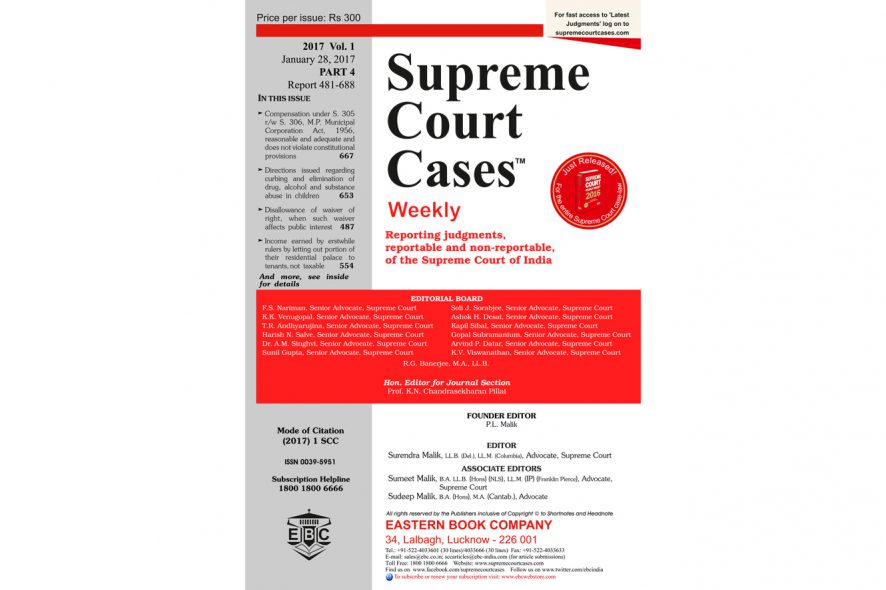

The picture of the book is wrongly showing as Part 4