A stock market (also known as an equity market or a share market) is a platform that facilitates trading in stocks (also called shares). These stocks represent ownership claims on businesses. The buyers and the sellers often execute their trade in the stock market via an electronic trading platform. There are two major stock exchanges in India viz. the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). As on April 30, 2020, the BSE had 5,542[1] listed firms, whereas NSE had about 1,795[2] listed firms as on March 31, 2020.

To gauge the performance of stock markets various indices are formulated. An index serves as an indicator of the performance of the overall market or a sub-segment/sector within the market. The two prominent indices in the Indian stock market are Sensex and Nifty. Sensex is the oldest market index for equities, which includes shares of top 30 companies listed on the BSE. Similarly, Nifty comprises of the top 50 shares listed on the NSE.

Settlement and Trading Mechanism

Trading at both the exchanges takes place through an electronic platform. An electronic order book is maintained for all the buy and sell orders. The orders placed by investors are automatically matched against the determined price (explained in a subsequent section) and therefore there is no direct interaction between the buyers and the sellers. This helps in bringing in more transparency by displaying all buy and sell orders. However, since there are no market makers in such a system therefore there is no guarantee that all orders will be executed. The stock markets have brokers, who act as facilitators of trade through their online trading facilities to both retail and institutional investors.

The settlement in the stock market happens two business days post the trading day (also abbreviated as ‘T+2 settlement mechanism’), which means that any trade taking place on Monday will be settled by Wednesday provided neither of Tuesday and Wednesday is a public holiday. A delayed settlement mechanism provides time to both the seller and buyer to arrange for required documents and for funds respectively for the trade to be executed. Each exchange has its own clearing house, which assumes all settlement risk by serving as a central counterparty.

Categories of investors

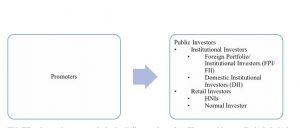

Investment in a Company is basically done by the promoter group or the public investors. The public investors can be further divided into institutional investors and retail investors. The following chart gives a brief overview of the various types of investors in the Indian context:

FPIs/FIIs play an important role in the Indian stock market. They would generally include hedge funds, foreign mutual funds, sovereign wealth funds, pension funds, asset management companies, amongst others. They have been pivotal in the growth of India’s financial markets over the last two decades. It is estimated that FPIs/FIIs would have invested around INR 12.5 trillion (USD 180 billion) in India between fiscal year 2002-2020 (till March 2020) as per the various media reports.

The role of DIIs has dramatically changed over the last five years as investors have started looking beyond the traditional gold and real estate as investment options. A rising middle class and a declining interest rate regime has also added to their fortunes. DIIs generally include mutual funds, insurance companies and banks/financial institutions. It is estimated that MFs alone have invested more than INR 4.5 trillion in Indian equities over last five years as per the various media reports.

Strong presence of FIIs/DIIs amongst a listed company’s shareholders is also considered as a proxy for good governance practices being followed by the Company.

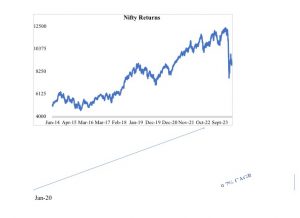

Supported by strong inflows from the FIIs/FPIs and DIIs, Indian stock markets have seen a healthy growth over the last decade. If we look at the returns just before the markets crashed due to COVID-19 pandemic, Nifty had grown at 9.7% compounded annual growth rate.

Pricing of shares on the stock exchange

Stocks are priced the same way any commodity is priced globally i.e. governed by the principals of supply and demand. Market participants place buy and sell orders which are also known as ‘bid’ and ‘ask’ respectively. Stock prices are determined by matching these buy and sell orders. The price of a stock at any point is the price at which maximum number of shares can be transacted basis the bids and asks at that time. After the price is arrived at, the open bid and ask positions are closed and the underlying transactions are completed. Thereafter, this price is displayed as the price of the stock for that moment. All this happens on real-time basis with the help of electronic platforms.

Price manipulation and Unfair Trade Practices in the Indian Stock Market

The basic rule governing securities market is that the parties shall not indulge in any fraudulent activities. Rigging the price of securities obstructs the free forces of supply and demand and makes the stock manipulated. Such a fraud occurs when an advisor or a stockbroker offers deficient or prejudiced information to control the market. A devious cartel develops which rigs the liquidity and price and this is called “price rigging”. Under price rigging, a stock is made to look liquid and valuable to a general investor while it is being traded only within a set of parties amongst themselves. This tempts such investors to invest in such shares chasing future value. This is where the devious cartel makes money as the innocent investor has invested in a stock at a falsely elevated price. There are many variations to this. Some of the popular variations are circular trading, pump and dump schemes, front running, etc. Another aspect is the unfair trade practice of insider trading by persons in possession of unpublished price sensitive information. Here we discuss them in detail with respect to the regulatory framework and controls in the Indian securities market.

Regulatory framework and controls facilitating fair market conduct

The Securities and Exchange Board of India (SEBI)[3] is vested with the responsibility of protecting the interests of investors in securities and promoting the development of the securities market. SEBI safeguards the integrity of the markets by making regulations which help in detecting market frauds on a proactive basis, inspecting abusive or manipulative dealings in the securities market and punishing the wrong doers by taking disciplinary action. SEBI has been given legislative, executive, and quasi-judicial powers under the SEBI Act, 1992 to help it in fulfilling its duties.

SEBI had framed the SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Markets) Regulations in 1995 to combat market abuse related to “market manipulation”. These Regulations were substituted with the SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market) Regulations, 2003 (“the PFUTP Regulations”) which were notified on 17th July, 2003.

SEBI had promulgated the SEBI (Prohibition of Insider Trading) Regulations, 1992 to combat market abuse related to “insider trading”. These regulations were amended in 2002 to bring in the concept of code of conduct for prevention of insider trading, as well as a code for corporate disclosure practices. Further these regulations were reviewed by the Sodhi Committee and were substituted by the SEBI (Prohibition of Insider Trading) Regulations, 2015[4] (“the Insider Trading Regulations” or “the PIT Regulations”).

During Financial Year 2018-19, 84[5] new cases of market manipulation and price rigging were taken up for investigation by SEBI. 60 cases were completed while 70[6] cases of insider trading were taken up for investigation by SEBI and 19 were completed. Strict classification under specific category becomes difficult since several investigation cases involve multiple allegations of violations. Therefore, cases are generally classified by SEBI on the basis of main charge/violations. Here we discuss the SEBI Regulations governing market abuse related to manipulation and insider trading.

1. SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market) Regulations, 2003 (“PFUTP Regulations”)

1.1 Scope of the PFUTP Regulations

The PFUTP Regulations deal with market abuse such as manipulative, fraudulent and unfair trade practices. Fraudulent and unfair trade practices are prohibited under Section 12-A of the SEBI Act. Pursuant to the recommendation of Committee on Fair Market Conduct or the T.K. Viswanathan Committee[7] (“the Committee”) in its Report dated 8th August 2018, SEBI has made amendment to the PFUTP Regulations vide the SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market) (Amendment) Regulations, 2018[8] (“the Amendment Regulations”). An attempt has been made by SEBI to bring the provisions of the PFUTP Regulations in sync with several Supreme Court judgments which have dealt with matters related to market manipulation, fraud, and unfair trade practices through these amendments.

A wide variety of practices undertaken to compromise the market’s integrity and efficiency for one’s personal gains are covered under market manipulation. Market Manipulation as defined in Palmer’s Company Law and noted by the Supreme Court[9], “Market manipulation is normally regarded as the ‘unwarranted’ interference in the operation of ordinary market forces of supply and demand and thus undermines the ‘integrity’ and efficiency of the market.”

The Supreme Court observed[10] that “market manipulation is a deliberate attempt to interfere with the free and fair operation of the market and create artificial, false or misleading appearances with respect to the price, market, product, security and currency.” Further the Supreme Court has also defined unfair trade practices in the aforesaid judgment as follows:

“Having regard to the fact that the dealings in the stock exchange are governed by the principles of fair play and transparency, one does not have to labour much on the meaning of unfair trade practices in securities. Contextually and in simple words, it means a practice which does not confirm to the fair and transparent principles of trades in the stock market.”

Under the PFUTP Regulations the burden of proof is on SEBI to show that the manipulation took place.

Wider ambit and broad safeguards

In SEBI v. Kanaiyalal Baldev Patel[11] the Supreme Court has interpreted the term ‘fraud’ to be wider than fraud as understood under the Contract Act, 1872. The Court held that, “The definition of “fraud”, which is an inclusive definition and, therefore, has to be understood to be broad and expansive, contemplates even an action or omission, as may be committed, even without any deceit if such act or omission has the effect of inducing another person to deal in securities. Certainly, the definition expands beyond what can be normally understood to be a “fraudulent act” or a conduct amounting to “fraud”. The emphasis is on the act of inducement and the scrutiny must, therefore, be on the meaning that must be attributed to the word “induce”.” The burden here, on SEBI, is not to prove that the inducement was done dishonestly or in bad faith by the person, but only to establish that the person so induced would not have acted the way he did if he was not induced. Thus, it can be concluded that SEBI is not required to prove that the intention of the person was to commit the fraud. However, it has even been expressly stated in the judgment that, “mens rea is not an indispensable requirement to attract the rigour of Regulations 3 and 4, and the correct test is one of preponderance of probabilities.” Further in this judgment, front running by a non-intermediary has been brought within the prohibition prescribed under Regulations 3 and 4(1) of the SEBI (Prohibition of Fraudulent and Unfair Trade Practices Relating to Securities Market) Regulations, 2003. A wider interpretation was given to the term ‘unfairness’ to be inclusive of the concepts of ‘deception’ and ‘fraud’. Unfair trade practices require adjudication on case-to-case basis. It was observed that, “If the conduct undermines the ethical standards and good faith dealings between parties engaged in business transactions then the trade practice is deemed to be unfair.”

Further in N. Narayanan v. Adjudicating Officer, SEBI[12], the Supreme Court has noted that, “manipulation in the price of securities can also be can also be achieved by inflating the company’s revenue, profits, security deposits and receivables, resulting in price rise of the scrip of the company.”

Based on the aforesaid judgments and the recommendations of the Committee[13], the scope of the definition of dealing in securities as laid down in Regulation 2(1)(b) of the PFUTP Regulations was broadened vide the Amendment Regulations to comprise of persons providing assistance in such dealing in securities. Further, based on the recommendations of the committee, Regulation 4 of the PFUTP Regulations was also amended vide the Amendment Regulations to expand the ambit of the PFUTP Regulations to restrict new practices that could perpetuate market abuse.

1.2 PFUTP Regulations – Combination of rule-based and principle-based approaches[14]

The Committee laid down that these Regulations are a combination of rule-based and principle-based approaches. The underlying broad principles governing fraudulent and unfair trade practices are laid down in Regulations 3 and 4(1) of the PFUTP Regulations and are intended to cover diverse situations and possibilities whereas Regulation 4(2) lays down specific rules that prohibit certain conduct by deeming them fraudulent activities or unfair trade practice.

Such a perspective not only speaks of the broad principles for ensuring fair markets but also enables rules to be specified to prohibit an illustrative list of identifiable unfair and manipulative trade practices thus being suitable for the present stage of market development. The Committee recommended that rule-based Regulation 4(2) to be updated at regular intervals to keep up with the changes in the securities market environment.

2. SEBI (Prohibition of Insider Trading) Regulations, 2015[15] (“PIT Regulations”)

2.1 General meaning of the term Insider Trading

‘Insider Trading’ is the unlawful act of dealing in securities of the Company by the person who has some information which is not accessible to the general public in the market thereby allowing them to make unlawful gains. Insider Trading is prohibited under Section 12-A of the SEBI Act. To regulate such trading, SEBI had promulgated the SEBI (Prohibition of Insider Trading) Regulations, 1992, which was reviewed by a High-Level Committee and culminated in the SEBI (Prohibition of Insider Trading) Regulations, 2015. Further, in Financial Year 2018-19 SEBI appointed the Committee and in accordance with the recommendations made by the Committee, these Regulations have been amended by way of the SEBI (Prohibition of Insider Trading) (Amendment) Regulations, 2018[16] i.e. the Amendment Regulations to strengthen transparency, enforcement mechanism and to ensure institutional responsibility.

2.2 Analysis of Insider Trading Regulations

Regulation 2(1)(g) of the SEBI (Prohibition of Insider Trading) Regulations, 2015, defines insider as:

- A connected person; or

- In possession of or having access to unpublished price sensitive information.

To distinguish an ordinary investor who trades in the stocks of a Company on the basis of his/her own financial knowledge from those who are either connected with the Company or have access to unpublished price sensitive information, SEBI coined the term “insider”. The intent here is to safeguard the interest of the investing public against any financial misfortunes.

Let us first look at what constitutes unpublished price sensitive information (UPSI). Any material information with regard to capital raising, mergers or demergers, acquisitions or business restructuring, unpublished financial results, bonus issues or any other information which can potentially impact the price of the security once made public is usually treated as UPSI. Here it is intended that anyone in possession of or having access to UPSI should be considered an “insider” regardless of how one came in possession of or had access to such information.

Another term which forms part of the definition of insider is “connected person”. The definition of “connected person”[17] has been broadened in the PIT Regulations, 2015 wherein any person who is or has during the six months prior to the act concerned been related to the Company in any manner, directly or indirectly and has access to unpublished price sensitive information (UPSI) or is reasonably deemed to have access to UPSI will be treated as a ‘connected person’. Therefore, even the support staff of the organisation including the office boys, driver, cleaner etc. will be included within the purview of the definition.

In the matter of Palred Technologies[18], SEBI held that persons connected to each other as mutual friends on social networking websites like Facebook, will also be treated as ‘insider’ in the event of any of them trading in the shares of the Company on the basis of UPSI. On the contrary, the Securities Appellate Tribunal (SAT) in a 2008 case[19] held that, “an auditor of the Company cannot be rationally considered to be in the possession of the information relating to merger of the Company with another, until it is confirmed that the valuation report on the merger prepared by the chartered accountant was made available to him. SAT further observed that, “No Company would allow such sensitive information to reach the auditor till it has been made public.” Therefore, the auditor cannot be considered as an insider just by virtue of his role. The main aspect in considering any person as an insider will be the possession of UPSI which he has had and in case, the contrary is proved, the said person will not be treated as an insider.

Regulation 2(1)(e) of the PIT Regulations defines “generally available information” as “information that is accessible to the public on a non-discriminatory basis.” This definition grants SEBI the ability to decide, on a case specific basis, whether certain information is available on a non-discriminatory basis, so as to not classify/treat it as a UPSI.

Regulation 3 of the PIT Regulations prohibits the communication and procurement of unpublished price sensitive information, unless such communication/procurement is in furtherance of legitimate purposes, performance of duties or discharge of legal obligations. Further, Regulation 3(2-A) lays down that, “The board of directors of a listed company shall make a policy for determination of “legitimate purposes” as a part of “Code of Fair Disclosure and Conduct” formulated under Regulation 8. Regulation 3(2-A) was inserted vide the Amendment Regulations on the recommendation[20] of the Committee wherein the Committee noted that the term legitimate purpose is not defined under PIT Regulations and is open to various strict and expansive interpretations[21].

Regulation 4 of the PIT Regulations prohibits trading by insiders while in possession of UPSI. However, the Regulation allows the insider to prove his innocence by demonstrating certain circumstances. The burden of proof is on the insider to show that he/she did not trade while in possession of inside information (“unpublished price sensitive information” or “UPSI”).

Thus, we see that the PIT Regulations put restrictions on communication and trading by insiders. Exceptions have been provided in the event of such communication being in furtherance of legitimate purposes or discharge of legal obligations. This necessitates all insiders of corporates not to disclose any information to anybody including, even other insiders which may result into disclosure of UPSI under the new code for insiders.

The penalty for insider trading is prescribed in the SEBI Act[22] which states that any insider who:

“either on his own behalf or on behalf of any other person, deals in securities of a body corporate listed on any stock exchange on the basis of any unpublished price-sensitive information; or communicates any unpublished price-sensitive information to any person, with or without his request for such information except as required in the ordinary course of business or under any law; or counsels, or procures for any other person to deal in any securities of anybody corporate on the basis of unpublished price-sensitive information, shall be liable to a penalty which shall not be less than ten lakh rupees but which may extend to twenty-five crore rupees or three times the amount of profits made out of insider trading, whichever is higher.”

Insider trading penalties in India, though having monetary quantification, do not have severe punishments/penalties, as is prevalent in other countries by way of imprisonment, supervised release and substantial payments in form of fines/penalties. The case and decision given by the District Court of New York in the matter involving Rajat Gupta, Director of Goldman Sachs and Rajaratnam, Founder of Galleon Group[23] is a testimony to the seriousness of other countries to curb insider trading.

3. Surveillance, Investigation and Enforcement by SEBI

SEBI has made appropriate laws and regulations to ensure market integrity, fair market conduct and protection of interest of investors. To ensure compliance with the aforesaid regulations SEBI has laid down mechanisms that helps in uncovering breaches through effective surveillance and investigation and penalty thereof by strong enforcement action.

Market Surveillance Division was set up in SEBI in July 1995, with a view to keep a proactive oversight on the surveillance activities of the stock exchanges[24].

The stock exchanges apprise SEBI of surveillance concerns and actions at the regular surveillance meetings. The stock exchanges also take punitive actions (suspension of the trading in the scrips, debarment of the suspected entities, etc.).[25]

Certain stocks lack liquidity thereby making it easier for unscrupulous elements to influence the price and volumes of stocks with lesser efforts. Liquidity is concentrated around the top 500 odd listed stocks. 100% dematerialisation of shares has been mandated on the recommendation of the committee on fair market conduct[26] in order to deter attempts at manipulation in stocks which are illiquid and have low market capitalisation. Further, the cost of trading in illiquid stocks has been increased. SEBI also has the powers to seek call data records (list of people in touch with the caller) of those being probed, but it cannot intercept calls.

In a recent case, In the matter of Indiabulls Ventures Limited[27], SEBI passed an order impounding INR 87.21 Lakhs belonging to Ms Pia Johnson, non-executive director of Indiabulls Ventures Ltd. (IVL), and her husband Mehul Johnson who traded in the scrip of IVL, based on UPSI communicated by his wife to him. The penalty levied here is only the collective alleged gains of the two with an annual 12% interest since the gains were made in the year 2017.

Here we can see that though the regulator has been stepping up the surveillance and other monitoring mechanisms for prevention of insider trading and other manipulative practices, a general sentiment that emerges is that the regulator needs to further tighten up on the penalties/punishments, which acts as a deterrent for committing such acts.

*Counsel, Neeti Niyaman

[1]https://www.bseindia.com/markets/keystatics/Keystat_Companies.aspx

[2] https://www.nseindia.com/regulations/listing-compliance/nse-market-capitalisation-all-companies

[3] Section 11 of Securities and Exchange Board of India Act, 1992 (SEBI Act, 1992)

[4] SEBI (Prohibition of Insider Trading) Regulations, 2015

[5] Annual report of SEBI for Financial Year 2018-19

[6] Annual report of SEBI for Financial Year 2018-19

[7] Report of Committee on Fair Market Conduct or TK Viswanathan Committee (August 08, 2018)

[9] N. Narayanan v. Adjudicating Officer (SEBI), (2013) 12 SCC 152

[10] SEBI v. Rakhi Trading (P) Ltd., (2018) 13 SCC 753

[11] (2017) 15 SCC 1

[12] (2013) 12 SCC 152

[13] Report of Committee on Fair Market Conduct or TK Viswanathan Committee

[14] Ibid

[15] Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015

[17] Regulation 2(d) of PIT Regulations, 2015

[18] In the matter of trading in the shares of Palred Technologies Limited, 2016 SCC OnLine SEBI 42

[19] Sadhana Nabera v. SEBI, 2009 SCC OnLine SEBI 20

[20] Report of Committee on Fair Market Conduct or TK Viswanathan Committee dated August 08, 2018

[21] Rakesh Agrawal v. SEBI, 2003 SCC Online SAT 38

[22] Section 15-G of the SEBI Act

[23] Securities and Exchange Commission v. Rajat K Gupta and Raj Rajaratnam, Civil Action No. 11-CV-7566 (SDNY) (JSR), Dod: 27.12.2012

[24] www.sebi.gov.in

[25] Annual report of SEBI for Financial Year 2018-19

[26] Report of Committee on Fair Market Conduct

Can a minor trade independently on Indian stock exchanges BSE/NSE? Can the minor file income tax returns independently if his trading results in profits say 2 Lakhs or will this income be clubbed with parents income?

Hello I found this blog very helpful and best regarding the niche of stock market investing your money is good but investing your money at right place is much important thing so therefore while doing trading in Nifty and stock please get full prepared about the company data and statics and growth .

this great blog on indian stock market and you have great knowledege of stock market.

Blogs are a great way to connect to people and provide useful information. You are able to achieve that in this post. Thanks for sharing this.

This is an amazing website and you’ve written amazing blogs on your website.

Thank you