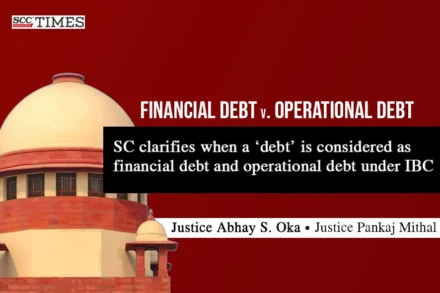

Supreme Court sets aside NCLAT order de-recognizing four lenders of the insolvent Reliance Infratel as Financial Creditors

Noting that hypothecation means the process of using an asset as collateral for a loan. It acts as a protection to the lender when the borrower does not repay the loan, the Supreme Court highlighted that the name of the document is not a decisive factor. Only because the title of the document contains the word hypothecation, it cannot be concluded that guarantee is not a part of this document.